The 50/30/20 budget is a widely used budgeting method that divvies up one’s post-tax income into three categories:

- 50% towards needs (housing, bills, groceries, etc)

- 30% towards wants

- 20% towards savings and investments

This method is a great starting point for people just starting to budget or for people at or around the median household income.

However, those with high incomes ($100,000+) should consider a few points before deciding to use this budet.

1. Just Because You Earn A Lot of Money Doesn’t Mean You Have To Spend A Lot of Money

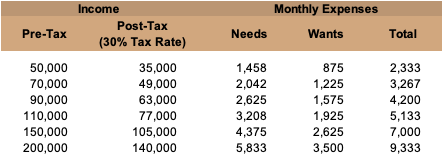

The 50/30/20 budgeting method suggests putting 50% of your post-tax income towards needs and 30% towards wants. Below I’ve laid out how much this would be for various salary levels:

As you can see, the total monthly expenses increases as income increases. Let’s put these numbers into a bit of context.

The average household income for American households is just around $80,000. The average monthly spending is $3,400 for individuals and between $5,000-8,000 for households with more than one person.

For smaller households, the recommended monthly expenses based on the 50/30/20 budget start to surpass average spending once income reaches $100,000+.

A high income earner could consider foregoing additional luxuries, and instead keep their expenses in line with average spending so that they could increase their savings and investments.

For an individual earning $150,000, this would equate to an additional $3,600 in savings a month!

2. You Could Be Losing Out on Millions In Retirement

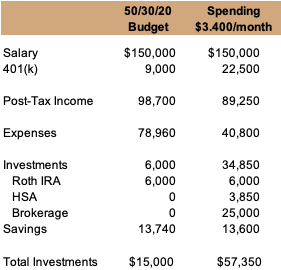

Let’s dive deeper into the example an income of $150,000. There are two versions of this budget: 1) following the 50/30/20 method, 2) spending $3400/month which is in-line with the national average.

Both budgets allow for a generous amount of savings and investments. However, the second budget leads to over $40,000 more in annual investments. This can translate to millions in retirement depending on how far away retirement is.

Bottom line is that high income earners should consider the tradeoffs of increasing expenses to match their income or keeping expenses low in order to invest more.

3. You May Not Be Maximizing Your Tax Savings

Again, let’s focus on the example income of $150,000. Contributing the max of $22,500 towards the 401(k) could lead to a savings of ~$3,000 in federal taxes.

Most companies set the default contribution much lower (3-6%) which means that only $4,500-$9,000 would be getting contributed to the 401(k). As you can see above, it is doable to set aside enough money to max out the 401(k). In order to contribute the max, you would have to manually adjust their contributions in your employer’s retirement portal.

Manually increasing contributions will not only set you up better for retirement, but it could also lead to tax savings!