I have been living in Chicago since March 2021, working as a consultant full time and living in an apartment with my friend/roommate. One of my goals as a wealth builder is to continually increase my income while keeping expenses constant.

As I was reviewing my past budget over the past year, I was surprised to see exactly how difficult it was to determine my success at this goal over the past year. The following analyses will attempt to answer the question: Am I increasing my income and keeping my expenses constant?

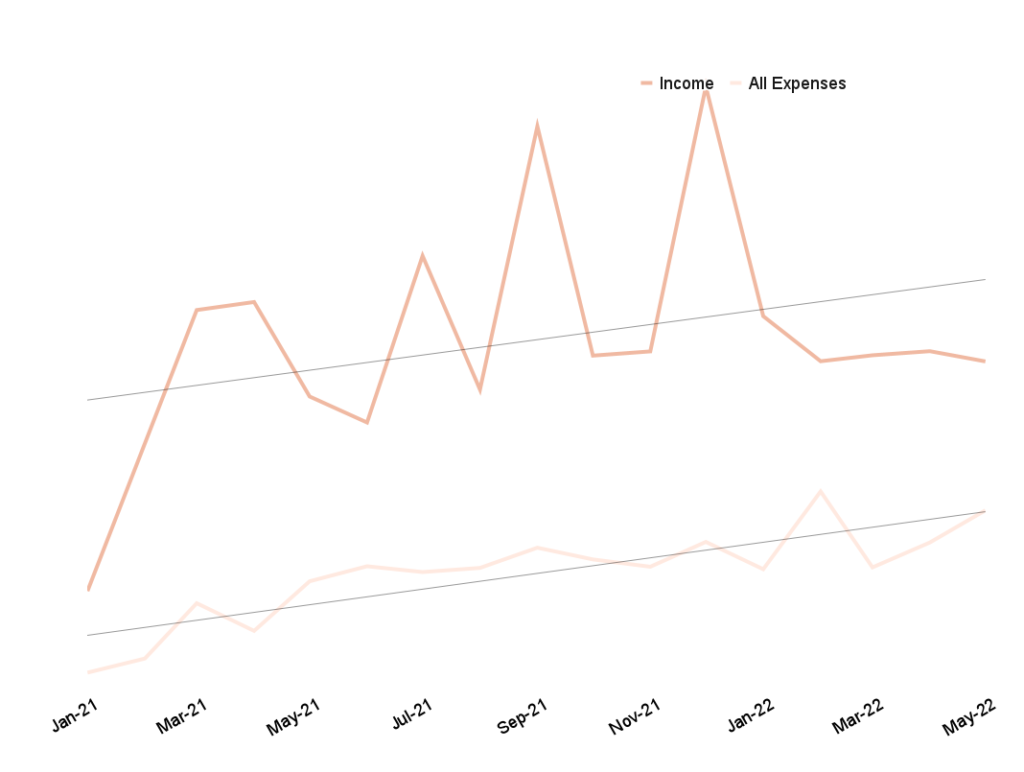

Average Increase (Slope of Trend Line)

From January 2021 to May 2022, I have increased my income an average of $4.86 and my expenses an average of $4.98 per day. This is the equivalent of the slope of a trend line in a line graph.

A trend-line is a good indicator of future patterns based on historical data. Therefore, my expenses haven’t literally increased $4.98 per day, but rather my best guess at how much I will spend tomorrow is $4.98 plus whatever I spent yesterday.

I am using the slope of a trend line in this analysis because it is a good measure of how my expenses and income have trended in the past year without focusing on the actual dollar amounts of these measures.

This result is a bit disappointing because the increase in expenses is bigger than the increase in income. Ideally, I would like my expenses to increase an average of $0 a day. You can see from the graph that there are a few factors that my be confounding the results.

- First, in January and February 2021, I was still living at home, so my expenses were super low and I was not earning money from my full-time job, yet. This is not very comparable to my current situation.

- Second, you can see big income peaks in 2021 which are from stimulus checks, three paycheck months, and yearly bonus. Obviously there were no stimulus checks in 2022, and I have not had any three paycheck months or received a yearly bonus, yet.

- Lastly, I am mainly concerned with keeping my regular expenses constant. This includes housing, food, and other discretionary spending that is fairly regular month to month. In areas such as travel and donations, I made conscious decisions to increase spending in 2022, so I would like to disaggregate that increase from the results.

Adjusting for Job Start Date

The first thing I did to adjust this analysis was to change the time frame I am analyzing. Since my situation in January and February of 2021 was vastly different from now, I exclude this from the analysis. Doing this results in an average daily increase of $0.01 for income and $3.65 for expenses.

Impact of Covid-19 Stimulus

I received my stimuli retroactively when I was filing my taxes. The first stimulus of $1,800 hit my account in March 2021 and the second of $1,400 hit my account in April 2021. Here, I will adjust my income for both months by subtracting these amounts. Doing this and the adjustment in the previous section results in an average daily increase of $2.47 for income and $3.65 for expenses.

Seasonal Salary Trends

There’s not much I can do to adjust for the fact that I haven’t had any three paycheck months or yearly bonus paid out, yet. Revisiting this analysis in September would help produce more robust results.

Lifestyle Inflation vs. Intentional Spending

The last thing I want to adjust for is focusing on actual lifestyle inflation rather than intentional increases in spending. I care most about keeping my day-to-day expenses relatively constant and avoiding adding in mindless additions like ordering take-out on weekdays and buying random things on Amazon. I intentionally decided to spend more on traveling (read about my 4-Day Miami getaway!)and donating to causes I care about in 2022 which has increased my spending significantly in certain months.

When I budget, I track “regular expenses” and “yearly expenses” which more or less follows the division I described above. After including only regular expenses and keeping the previous adjustments, the average daily increase for expenses is a mere $0.50 and the average daily increase for income is still $2.47.

Areas of Improvement

My goal is keep lifestyle inflation at a minimum. Ideally, I would be keeping my expenses constant while increasing my income. Any additional income would go toward saving and investments rather than more expenses.

If I look at my fully adjusted analysis, it is evident that I am still experiencing a small amount of lifestyle inflation, however, my income is increasing at a faster rate than my expenses.

Going forward, I think it is important to focus on increasing my income as much as I can. There is an infinite ceiling to my income whereas I can only decrease my expenses so much.

Even though I am not currently focused on decreasing my expenses, I will continue to be mindful not to introduce useless additional costs into my budget. Mindful spending, such as the travel and donations that I introduced this year are totally fine, as long as they align with my values!