Hi everyone, Julia here. I am super excited about the topic we’ll be covering today. I’m about to blow your mind (I hope). If I don’t that means that you already have done your homework on the benefits of tax-exempt retirement funds, so high five!

I’m sure you’re used to everyone saying that it’s important to save for retirement for future security and the “tax benefits”. But then you’re like, “what even are tax benefits anyway?”. Yeah that’s what I thought, too. It wasn’t until I sat down and did what I like to do best. I went into excel and crunched some numbers to figure out what exactly these tax benefits were.

It turns out tax benefits are amazing. In this post I’m going to show you just how amazing. If you want to see how to turn tax benefits into $5,850[1] of free money, read on.

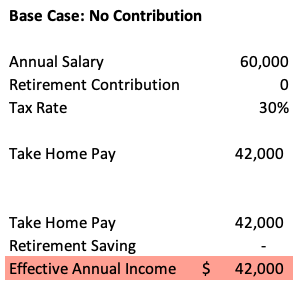

Base Case

As always, I’m starting off this crunch with the base case. This means that I am basing my future calculations on a sample scenario with specific assumptions. Thus, please do not construe any of this information as directly applicable to your unique situation. Of course, tax exempt accounts will benefit you, but the benefits will manifest in different amounts based on your income, tax rate, etc.

Here we have a $60,000 base salary. This is the pre-tax amount. You can find this amount on your offer letter usually. This amount is usually beautiful and exciting at first, but then you realize just how much taxes can take off. Here, I demonstrate that at a 30% tax rate, your salary would effectively be $42,000.

Effective Annual Income

Let’s take a quick definition break. You can see that I’m using the fancy term ~effective annual income~ to describe the after-tax salary. You may be like, but Julia, why aren’t you just saying after-tax salary? Well friends, the answer becomes clear in the next example, but for those of you chomping at the bits for a definition I’ll give it to you.

I define effective annual income as the income that you receive either now or in the future. It’s the total amount of money that your present self or your future self will have access to. This is different from after-tax salary because after-tax salary also deducts your 401k contributions. Effective annual income deducts tax but adds back 401k contributions.

I like using this measure to see the full value I’m gaining from contributing to the 401k. As you will see in the next two examples, there is a clear correlation between effective annual income and 401k contributions. Spoiler alert: it’s positive.

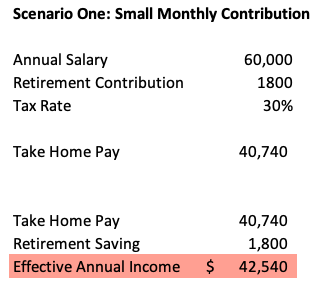

Scenario 1: Small Monthly Contribution

So, let’s break this down: In this scenario, you are contributing $150/month to retirement which comes out to $1800/year.

As you can see, your take home pay (aka after-tax income) is $1,260 less than in the base case. This means that you will have less cash available to meet your needs and wants in the present.

However, your effective annual income is actually BIGGER than the base case. It’s bigger by $540. This, right here, is the freaking tax benefits that everyone goes on about. This $540 is money that would have been put towards taxes but is instead kept with you for your future self to use.

The tradeoff here is that you must wait to use some of your money in retirement, but you get to keep more of it for yourself.

This is why you should always consider effective annual income to measure your financial benefit when it comes to retirement decisions. If you only looked at after-tax income when increasing retirement contributions, you would only see a dwindling number which may be sad and discouraging.

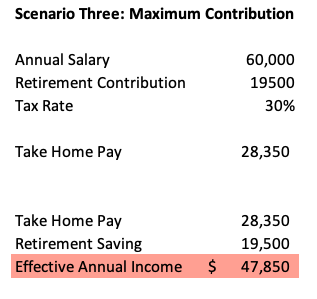

Scenario Two: Maximum 401k Contribution

To really drive home this point of effective annual income, let’s look at the extreme case of maximum retirement contribution. As per the IRS, you may contribute a maximum of $19,500 to your 401k each year. Although this is definitely not attainable for most college grads, it’s worth it to consider this case when learning about tax benefits.

As you can see, the take home pay is $28,350 which is $13,650 less than the base case. Again, this may mean some serious cash flow issues if your income can’t cover your yearly expenses.

On the flip side, effective annual income skyrockets to $47,500. This is a whopping $5,850 more than that of the base case—a 14% increase! Essentially, you are diverting this $5850 away from taxes and toward your future self.

So, What Does this Mean for Me?

There are two main things you should take away from this crunch. 1) tax-exempt retirement accounts are your friend and can give you free money. 2) deciding how much to contribute to your 401k should be a careful balancing of short-term liquidity needs and long-term value maximization.

Before your retirement account even makes a cent (or two cents!) off of interest or dividends, you are essentially gaining value from making the decision to invest that you wouldn’t have gotten otherwise. The difference between effective annual income in the base case and each scenario is that value that you are gaining!

When deciding how much to invest ask yourself how much money you really need in a liquid form (i.e. direct deposits to your checking account) and seriously consider diverting the rest to your retirement account. Not doing so is basically turning down free money.

Note: I intentionally decided not to include employer matching into this crunch. I wanted to home in on the tax benefits of 401k’s specifically and didn’t want to complicate things. If you are interested in seeing a similar analysis related to employer matching let me know in my social dm’s or in the comments below!

[1] Based on a $60,000 base salary and 30% tax rate.