Recently, I was watching my nightly round-up of YouTube videos—family vloggers, tiny house van tours, drug-store makeup reviews—when I saw a video recommendation from Zoe Pritchard who I’d recently found from her video about quitting her job at a Big 4 consulting firm. I had found it really intriguing since I had gone through Big 4 recruiting not too long ago. Her new video was all about her current budget and how she wants to change it.

Admittedly, I’ve seen a lot of videos about people’s money habits since it seems to be a pretty trendy topic, however, Zoe’s video was so intriguing to me for two reasons 1) she is very similar to me both in the industry she works and her age and 2) she was so open and honest about not only her spending habits but also her emotions surrounding those habits.

Although I enjoy learning and writing about personal finance and with my background and education in finance and investing, I do feel as if I have some value to offer even in this stage before I start my job and manage my own money, nothing can beat real experience when it comes to understanding the challenges and pitfalls one may encounter as they begin their first job.

Right after I finished the video, I knew that I wanted to meet and interview Zoe for my blog because her experience would be invaluable to you all—especially those of you who will be starting in a similar industry to consulting. I know that I gained a lot from our conversation already!

Before reading this, I encourage you to go over to Zoe’s YouTube channel and watch her video because I reference it a couple times throughout this interview.

The interview was pretty casual and focuses mostly on how she managed her money this past year, how she wished she would have done it, and how she is planning to manage it going forward.

Near the end I present her with a few number crunches I did using her specific budget information to show her how much of an impact a few lifestyle changes can have on her financial situation!

Zoe and Julia’s Conversation

This interview has been paraphrased and shortened! All the main points are the same and direct quotes have been included.

Hi Zoe! Thank you so much for being here as my first interviewee for Money Talks. I can’t wait to dig a little bit deeper into the things you discussed in your video. First, I’d like to ask whether you did any financial planning or budgeting before you started work?

The short answer is no, I did not do any planning before my first paycheck. To give you a bit of background, I graduated in July 2019 with $22,000 in student loan debt for which I didn’t owe interest for a while and $10,000 on a line of credit. Right away, my mom freaked out a little bit about whether I’d be able to pay off that line of credit and helped me to pay down a significant chunk of it. Around this time, I also signed a lease on an expensive apartment because I was excited about the prospect of the size of my paycheck.

Before starting work, I also didn’t talk to anyone about money because I didn’t know who to talk to. My mom is protective of money and has fear surrounding it and my dad is more of a money in, money out personality. I also didn’t feel like I had to talk to anyone because I was a young professional and I felt as if I could do whatever I wanted to do.

“Sometimes it’s hard to talk about money with our parents so having that conversation with our friends can be really good”

Another thing that happened before my first paycheck was that I received a signing bonus which amounted to $3500 post-tax. I really wanted to buy a Gucci bag with this bonus because I thought it was something that would fit my young professional lifestyle. Luckily, my friend was like “no way”. She told me I’d look stupid since I was carrying so much debt. I appreciated the advice because sometimes it’s hard to talk about money with your parents, so it can be good to get that feedback with friends. Instead of the Gucci bag, I went ahead and paid off the rest of my line of credit with the bonus.

“The number you see on your job offer is not what’s going into your bank account and you need to know what’s going into your bank account”

I think that one thing that is really important to consider when receiving a job offer is how much it will actually be once tax is removed. I had no idea how much tax would be taken off and never really considered it. The number you see on the job offer is not the number that’s going into your bank account.

I spent my first few paychecks on a lot of things like going out to dinner multiple times a week, getting expensive cocktails, leaving generous tips. I was really high on the perceived lifestyle of a consultant and really identified with it. I felt entitled to all these things because that’s what a young professional is “supposed to do”. As a result, I was racking up a lot of money on my credit card and didn’t get to start paying off my student loans as quickly as I would have wanted.

Do you think your life inflation was more socially pressured or a product of your perception of what your life should look like?

I think it was both. So, most of my friends studied the same thing and got the same type of job as I did. A lot even worked at the same company as me. We were all high on this lifestyle together. We were constantly getting drinks, constantly eating out. We all felt entitled to it.

“I think it’s important to do an inventory of the people you’re surrounded with”.

Also, a lot of the people I worked with were already privileged. Their parents were paying for down payments on condos and they didn’t owe any debt. “I think it’s important to do an inventory of the people you’re surrounded with”. I didn’t need to keep up with these people, but I was trying to anyways.

In your video, you mentioned how your increased life satisfaction during the No Spend February Challenge played into its success since you had just quit your job. How do you think job and life satisfaction plays into spending decisions? Even though your first job paid above average do you think that it was actually a bad financial decision since spending is an emotional reaction for you?

Looking back, I wouldn’t change anything because I know what I never want to experience again. That job also set a base salary that I was offered once, so I know I can be offered it again, so I’m grateful for that.

I think that it would have just been about changing my mindet and realizing that making an above average salary can help me to get out of debt faster.

On the other hand, if someone’s looking at a job that they know they’ll hate but pays really high, don’t take it because you’ll blow all your money on emotional spending, shopping and eating. You’ll be buying coffee and food to get through the day. I don’t think the bump up in salary is worth that.

Do you think your shopping habits have changed since college and has making more money had anything to do with that?

Yes. I was a Forever 21 gal in college and would only shop at cheap stores. I remember being with my friend and when we both got our new jobs, we decided we needed whole new wardrobes for work. We went to downtown Montreal and spent literally thousands of dollars. We went to Aritzia and spent $600 each.

We thought “we’re young professionals now and we’re investing in our wardrobes”. I always had this mindset where I thought I needed to invest in quality clothes. Joke’s on me now that we’re in quarantine and my expensive blazers are not seeing the light of day.

In retrospect, do you think it could have been possible for you to budget, save more, spend less? What specific actions do you wish you would have done 12 months ago?

I think it would have been possible and there’s a few specific things I wish I would have done.

First is wardrobe-wise, I didn’t need two month’s worth of clothes to start my job. I should’ve started with one week’s worth and then bought more the next week if I needed it. Like for example, before starting work, I bought a bunch of blazers, but it turns out nobody there wears blazers. I think it’s important to see what other people wear before you go out and buy a bunch of clothes. Also, I didn’t even keep the job that I bought all the clothes for and now my new job has a completely different wardrobe.

“Don’t spend money because you feel you need to fit in.”

Next, I would say I should have been more careful about going out with my friends. If your friendships are all centered on going out after work, those friends won’t be there when you quit your job. They’re not long-term friendships worth investing too much in. In this case, it’s actual money you’re investing. I didn’t need to buy three $20 cocktails every night. Buy the cheapest wine on the menu instead and sip it. I remember around February, my friends and I went to this fancy opening night at a bar and it was hard because I was on my no-spend challenge and my friends were asking why I wasn’t drinking. I didn’t cave though, and I got fizzy water and put a straw in it instead. Don’t spend money because you feel you need to fit in.

Where would you like to be financially in the next 12 months?

In a perfect world, I’d be out of debt. Right now, that’s my priority. I know that some people would disagree with that and think you should be saving more than paying off debt. For me, my debt causes me a lot of anxiety, so that’s what I’m prioritizing.

“For me, my debt causes me a lot of anxiety, so that’s why I’m prioritizing it.”

In 12 months, I would also like to have a budget that I stick to. I’d like to have a better idea generally of what comes in and what comes out. Right now, I don’t have that. I think that will allow me not to feel guilty when I do spend money on clothes, a trip, drinks out at the bar.

What actions have you been able to take since you posted your Youtube video?

I have paid off the balance on my line of credit. I have also been planning bigger payments on my student loan starting in June. I will actually be doubling my payments.

I have also been thinking about the power of making more money so I can save more money. I think that anybody can make more money. For me, it’s through my YouTube, but I’ve also looked into tutoring kids in English virtually. I look at my Youtube money as not my money. It’s future me’s money. It’s for my loans or my savings. Current Zoe does not get to touch it.

Don’t treat your side income as your spending money. If you put it all towards loans or savings, it’s a good way to reach your goal faster.

Zoe’s Crunch: Lifestyle Changes Towards Financial Health

Near the end of our conversation, I walked Zoe through some simple projections that I had run to show her how some easy lifestyle changes could drastically impact her finances a year, two and even twenty in the future. I based my analysis on specific areas that Zoe herself had expressed interest in changing on her video.

Current Budget

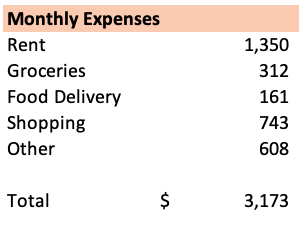

Zoe walked us through her expenses for the past two months in her video. From there, I divided each by two to get a rough monthly budget. She had identified shopping, food delivery, and other as areas that she would like to work on.

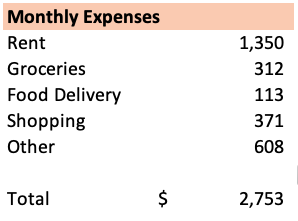

Goal: Cut Shopping by 50% and Food Delivery by 30%

The first scenario I ran was to cut shopping by 50% and food delivery by 30% which are fairly modest lifestyle changes and two areas that Zoe herself expressed interest in cutting. Her new budget with these changes is below.

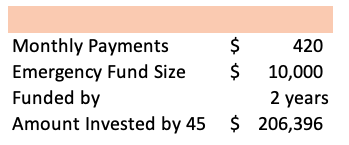

These changes result in a new monthly budget of $2,753. The total amount Zoe would be saving each month is $420. On the right, you can see that this monthly saving can be funneled into two different financial areas.

First, for two years, Zoe can make monthly contributions of $420 to a savings account in order to end up with a $10,000 emergency fund.

At that point Zoe would be 25 and could then begin contributing to an investment account whether that be a tax-advantaged retirement account or a brokerage account. After 20 years of contributing $420/month, Zoe would be expected to have $206,000 assuming that the account grows at an average annual rate of 7%.

When I presented these results to Zoe, she believed it was totally doable to make these simple lifestyle changes. Although, she did say she would be focusing on her debt payoff first. Even if she decided to funnel these funds towards debt, she would be making a significant dent in her debt and would probably be able to pay it off much faster than she would have otherwise.

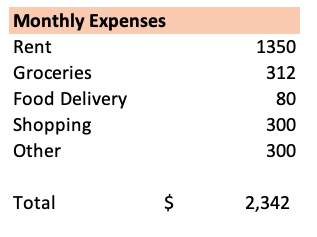

Goal: $10,000 Emergency Fund in One Year

Next, I explored what type of lifestyle changes Zoe would need to make in order to fund a $10,000 emergency fund in one year. In her video, Zoe said that if she were to lose her job tomorrow, she would have no way of paying her rent or getting food on the table. With a $10,000 emergency fund, Zoe would buy herself precious time in a time of crisis or even allow her to cover unexpected expenses for a health emergency or laptop replacement.

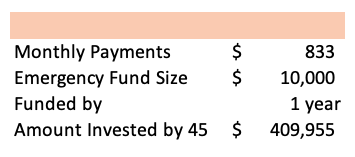

$10,000 seems like a lot to save in a year, however, I was able to identify three areas that Zoe could target in her budget to make this possible. She could cut food delivery by 50%, shopping by 60%, and other by 50%. This would result in $833 of savings each month. Zoe shared that the other category includes a large one-time furniture purchase, so I believe that these changes are very reasonable.

After building up her emergency fund in one year, Zoe could put the $833 towards investments and in 20 years, her expected balance would be a whopping $409,955.

After I walked Zoe through these numbers, she was both floored and really excited to start implementing some of these changes to help reach her goals faster. She said it was crazy that all this money is just hanging in her closet right now when it could be put to a much better use.

Takeaways

I’m so glad that I got to talk to Zoe and share it with all of you. As we are preparing to start our lives as adults, it’s easy to put off the planning that is required to give yourself a strong financial foundation. All too often, clothing, expensive drinks, takeout among other things can drain the money out of our wallet.

I hope that this conversation with Zoe and the number crunch helps you to understand the big challenges around getting your first paycheck and figuring out how to use it. Some key steps you can take before that paycheck is even in your hands is to form a budget, calculate your after-tax income, set up a separate savings and checking account, and set up automatic deposits to savings as well as contributions to your 401k. Definitely continue to read my blog as I navigate these steps myself and also follow Zoe’s YouTube channel for updates on how she’s making changes in her finances.